Loans For Unemployed Canada

Unlock the financial opportunities with loans for unemployed Canadians.

- *Whizz is an independent comparison website, not a lender or a broker.

- *Applying won't affect your credit score.

- *All loans are subject to creditworthiness and affordability checks.

Save thousands of dollars with our Fixed and Lowest ever interest rate loans.

Why a large number of people choose Whizz? Because we brightening their rainy days since 2017. We made online borrowing simpler, faster, and more affordable.

Why choose "Whizz"?

Need urgent money? Don't worry! Apply online and get fast approval*.

Borrow $100 to $5k

You are free to borrow as min $100 to max $5000 with long repayments terms.

Secure application

Use our modern age secured application process to ensure you get funds securely and quickly.

Instant cash access

Want to quickly access your credit? We approve your small loan online within few minutes.

Dedicated support

Our loan specialists are always ready to help you throughout the whole process until you get approval.

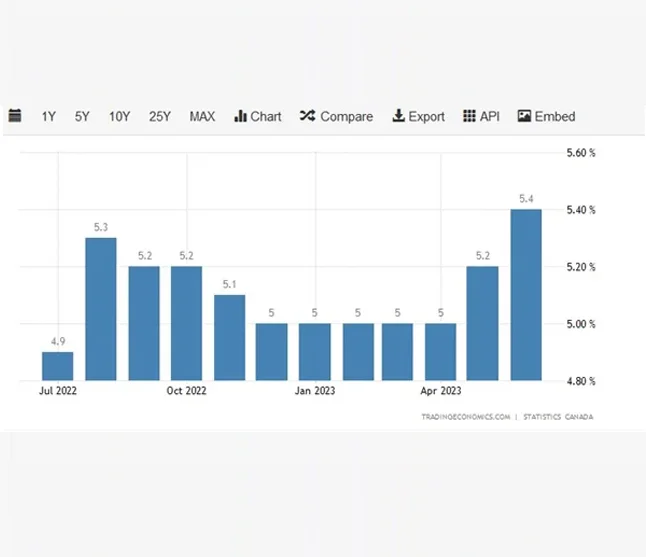

Did You Know? The unemployment rate in Canada rose to 5.4% in June 2025 compared to 5.2% in the previous year. Unfortunately, it is true according to a Statistics Canada fresh report. It further revealed that the overall employment rate was unchanged, with a 0.1% decrease in May.

According to Trading Economics, the unemployment rate in Canada is expected to be 5.60% by the end of this quarter. In the long run, the Canada Unemployment Rate is projected to remain around 6% percent in the 2025 year.

Source: Statics Canada and Trading Economics.

"The economy lost just over 17,000 jobs for the month, according to Statistics Canada, bringing the unemployment rate up to 5.2 per cent from the five per cent recorded in April."

What type of lenders accept you if you're unemployed?

Generally, lenders who offer loans for unemployed Canadians are specialized in providing loans to people with low income, bad credit history, and living on benefits. They differ from conventional lenders and accept loan applications based on the applicant's affordability and financial situation.

Such lenders offer short-term loans such as payday loans and accept all forms of income. They allow to borrow small amounts of money with repayment time under a year. Our payday loans for unemployed on benefits in Canada are easy to approve and aren't tied to long-term financial commitment.

How loans for unemployed work?

Getting unemployment loans in Canada works similarly to any other online loan. The only difference is your income source. Unlike regular employment income, you will be eligible for a loan based on your benefits income, like EI payments.

You can directly apply to a lender, and they will review your application to determine if you are eligible for a loan or not. Before applying, thoroughly check your lender's eligibility criteria; every lender has their eligibility requirements, so make sure you match them.

If your application is approved, the lender will directly transfer money into your bank account and collect the repayments with interest rates and fees on the agreed date.

You may find that loans on unemployment benefits are offered at higher interest rates than other forms of loans. It is obvious because of more risk associated for the lenders to lend the money where chances of repayment are meagre due to lack of stable income.

Is it possible to get a loan with no income at all?

No-loan approval is based on the borrower's ability to repay on the agreed date. So, if you have no income source, your chances of getting a loan are very low or impossible. In this case, you may apply for unemployment benefits such as Employment Insurance (EI) or apply for a guarantor loan.

Applying for a loan when you have no other income source is a bad decision. It may add extra strain to your finances and worsen your financial situation. It is recommended to apply for a loan when you have enough income to afford it.

Do benefits count as income in Canada?

Yes- Just because you are unemployed doesn't mean you have no income. If you enroll yourself for unemployment benefits such as EI or CPP, some lenders in Canada are willing to lend you money.

At Whizz, we welcome loan applications from jobless people who receive monthly payments from their unemployment or disability benefits. Our lenders review every applicant individually; if you can afford the loan, they approve your loan.

What eligibility requirements must be met for an unemployed loan in Canada?

If you are living on unemployment benefits and want to qualify for instant online loans while unemployed in Canada, you need to match with the following standard eligibility criteria:

- Your age should be above 18 years.

- Have a recurring income from unemployment benefits (EI payments).

- You must be a citizen of Canada or a permanent citizen.

- A valid and active Canadian bank with an e-transfer facility is required.

- You must have a valid mobile phone number, email, and residential address.

We also provide instant payday loans online to those living on government assistance in Canada. We offer Child tax loans, Disability loans, CPP loans, and Pensioner loans.

How to apply for a loan while unemployed?

If you want to apply for emergency loans for the unemployed in Canada 24/7, you'll get superior and streamless services at Whizz. We understand that arranging everything during the unemployment period is very difficult, especially when facing a cash shortage.

To solve this problem, we offer the fastest e-transfer payday loans for unemployed people living on EI; follow the three steps below and get closer to getting a loan.

- ✅ Step 1: Fill out our fast, online, secure loan application form with your details.

- ✅ Step 2: Our lenders review your details to provide an instant decision and email you a loan offer if approved. Thoroughly read it; if you find it perfect, accept it by electronic signature.

- ✅ Step 3: Once you accept the loan offer, money will be deposited into your bank account within 5 minutes via e-transfer.

Loans For Unemployed Canada- Some FAQ's

Ready to get started?

Apply online, get instant decision, and if approved, access up to $1,500 or more.